The coronavirus butterfly effect: Six predictions for a new world order

The world may soon pass “peak virus.” But true recovery will take years—and the ripple effects will be seismic. Parag Khanna and Karan Khemka forecast the aftershocks.

BY PARAG KHANNA AND KARAN KHEMKA8 MINUTE READ

In chaos theory, the butterfly effect describes a small change that can have massive, unpredictable consequences. An insect flaps its wings and, weeks later, causes a tornado.

The coronavirus is more like an earthquake, with aftershocks that will permanently reshape the world.

If we are lucky, the world will pass “peak virus” within the next six months. But the economy, governments, and social institutions will take years to recover in the best-case scenario. Indeed, rather than even speak of “recovery,” which implies a return to how things were, it would be wise to project what new direction civilization will take. That too will be a bumpy ride. The next 3-5 years will remind us that COVID-19 was the lightning before the thunder.

Of course, it is difficult to draw straight lines between cause and effect. With the benefit of hindsight, we can trace how the Treaty of Versailles and the Great Depression enabled the rise of Hitler. But in the hyperconnected world of today, dense global networks enable butterfly effects to ripple and amplify far more rapidly.

Can we forward-engineer probable scenarios emerging from the consequences of today’s pandemic? Given how stretched our institutions are in coping with the current crisis, few tasks could be more urgent in helping us prepare for the future. It is easy to predict further doom after a devastating phenomenon such as the coronavirus. Reality will likely turn out differently—and it certainly can.

THE LONG EMERGENCY

The most obvious tail-risk scenario to consider is that the numerous existing strains of COVID-19 encircling the world continue to ravage societies and the search for a vaccine proves more elusive, extending beyond the currently forecast 12-18 months. Countries that have accepted the rhythms of shelter-in-place policies and deployed contact-tracing technologies may be able to isolate pockets of exposure through strict quarantines, but poor and densely populated countries will remain especially unprepared and vulnerable. The aggregate death toll crosses from under 100,000 at present to nearly one million or more. At the moment, all countries are self-isolating, but in this trajectory, some countries would be indefinitely ring-fenced from physical exchange with others. Domestically, they face a painful choice between reopening their economies and exposing their populations to further infection.

We should therefore be cautious about forecasts suggesting we face only a U- or V-shaped recession. Numerous factors militate against this sanguine view. Most importantly, supply chains and markets are more integrated than commonly appreciated, and near-shoring is more difficult than the wave of a pen. The current American debacle with surgical masks and ventilators is a case in point. Emerging markets and developing countries are critical both as suppliers and markets. Their demise weakens the world economy as a whole.

Furthermore, domestic unemployment is reaching Depression-era levels, and the current relief packages don’t yet amount to the stimulus that many Western publics may need for years to come. Precautionary savings and muted consumption will govern household spending decisions, and business investment will sag. A long-drawn-out W shape is therefore the most likely economic scenario for the years ahead.

At a human level, the current economic nosedive is so steep that GDP figures are the last thing on most people’s minds. For governments and corporates, however, spiraling debt is a matter of immense concern. Once revolving credit lines are tapped out, numerous large firms will collapse or be consolidated. Industries from commercial real estate to aviation will suffer enormous write-downs on office buildings and shopping malls, airlines and airports. While European social policy keeps households afloat far better than America’s meager welfare, America’s single market is far more efficient than the eurozone, where leaders won’t agree to a sufficiently large mutualized debt scheme. As large employers (and the states or provinces that depend on their tax revenue) collapse, governments may fall.

THE “SUEZ SCENARIO”

Outright state collapse is not an implausible scenario for petro-states from Ecuador to Iran. Venezuela’s recent years of hyperinflation and starvation will be compounded by trickling aid and oil prices hitting bottom. Much as the 1980s oil trough hastened the disintegration of the Soviet Union, the combination of oil prices cratering and the likelihood that the hajj will have to be canceled eviscerates Saudi Arabia’s two largest sources of revenue. The high virus infection rate in Iran has been compounded by the stranglehold of American sanctions. Petro-states and developing countries have flocked to the IMF to access its emergency lending facility and have also drawn down their USD reserves to buttress their financing and stave off capital flight. Gulf states may need to loosen their U.S. dollar pegs.

It would be too simplistic to suggest that China will fill the void. Given its own difficulties with zombie firms, high municipal debt, and shift into deficits, Beijing has held back from extending generous credit to its usual client states such as Iran and Pakistan. Yet a “Suez scenario” remains plausible, harkening to the 1956 episode in which the Eisenhower administration threatened to withhold support for the British pound unless Britain withdrew its forces from the Suez Canal. With U.S.-China trade trending sharply downward and China angling to re-price oil into renminbi, a fragmentation of the global monetary order is a possibility for which all countries should prepare.

ANOTHER MIGRANT CRISIS

Global economic fragmentation and diminished international lifelines all but ensure that people will continue to flee failing states. Turkey has made clear it wants neither to house four million Syrian refugees in perpetuity nor to tolerate a mass virus outbreak. Dwindling Gulf support for Egypt and Sudan could spark an exodus from those states as well. Thus we should expect the migrant crisis from Central America into Mexico and the Middle East into Europe to surge again.

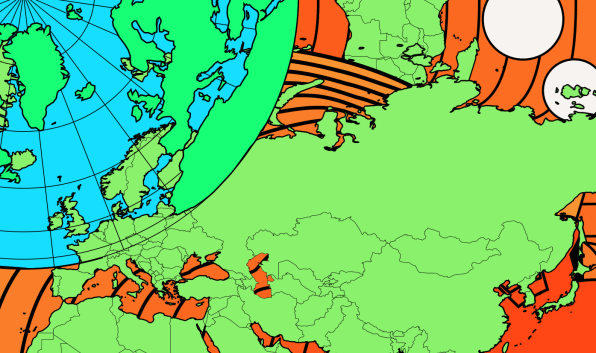

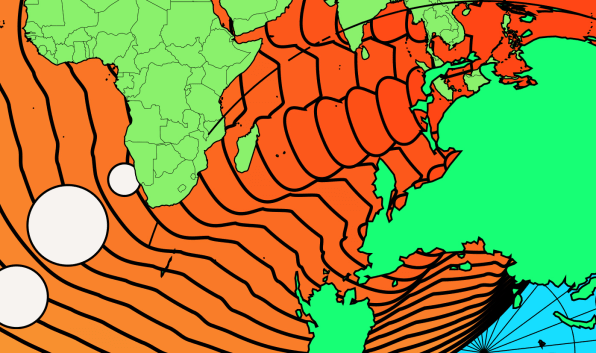

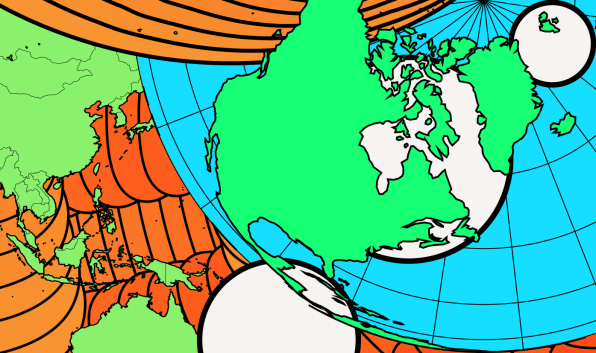

More broadly, if and when the pandemic restrictions on cross-border mobility lift, millions of other people will seek to escape “red zone” geographies with inadequate healthcare in favor of “green zones” with better medical care. At present, almost all the countries that offer universal medical care are in Europe. Those with skills and “immunity passports” may well gain entry as some wealthier countries seek migrants to contribute to a consumption rebound and fill labor shortages. Within countries, the flight from expensive tier-one cities to more affordable provincial areas will likely accelerate. In America, they may benefit cities such as Denver and Charlotte; in Europe, Lisbon and Athens.

RISING NATIONALISM

Before many countries contemplate jump-starting migration, however, they will likely first undertake a serious review of their food and medical supplies and perhaps engage in the kind of stockpiling or “food nationalism” that Russia has done in limiting grain exports and Vietnam with restricting rice exports. A decade ago, the agricultural price volatility exacerbated by Russia’s banning of wheat exports helped push Egypt and Tunisia over the edge. We should not be surprised for this recent history to repeat itself in numerous countries.

It would be wildly optimistic to predict, even to hope, that multilateral institutions will be upgraded by great powers to better cope with future shocks. China’s recent manipulation of the WHO and admission to the Human Rights Council, as well as the complete sidelining of the UN Security Council, suggest the United Nations will continue its terminal decay. While the IMF has temporarily restored its relevance, macroprudential supervision will fall by the wayside. The World Bank is woefully slow and underresourced.

The most optimistic scenario, then, is a revival of regional organizations. The EU has a chance to bring about the fiscal union it needs more than ever, but it remains unclear whether it will take it. Asian countries have just passed a Regional Comprehensive Economic Partnership (RCEP) and will need to deepen their internal trade to cope with the global demand shock. North America’s three states already trade more with each other than with China or Europe. Regionalization will be the new globalization.

TECHNOLOGY VERSUS THE COST CURVE

What investments can we make or deepen today to blunt the impact of the coronavirus pandemic and steer the future in a more stable and sustainable direction?

Greater investment in biotechnology and healthcare are obvious places to start—but not in their current form. Healthcare is being defined as a social good worldwide (as is already the case in Europe), but its cost is coming under scrutiny. Cost-effective universal provision can only be achieved through a model that emphasizes telemedicine and localized clinics and treatment centers. The push being made in this direction even in poor countries such as India and Indonesia may be instructive for much of the world. Fragmentation of life sciences regulation must also be overcome if we are to sustain the “science diplomacy” that has sprouted amid this pandemic and reverse the decades-long trend where the cost to produce a new drug has doubled with every passing decade.

Along similar lines, private education will receive substantially more investment given its strong performance during the crisis, but with a focus on digital delivery. This in turn should demonstrate how broad innovation in public education can be achieved cost-effectively as well. Digitization of financial services, which had already mushroomed prior to the pandemic, should be pushed to every living person in its wake. Neither widening inequality nor anemic consumption can be overcome without it.

CIVILIZATIONAL THREATS

The coronavirus has proven to be a greater test for leadership than 9/11 and the financial crisis combined, a sobering shock that has shattered complacent assumptions that progress always moves “up and to the right.” Evolution, both biological and civilizational, is a much more haphazard and indeterminate process. Moving forward, public- and private-sector leaders will have to accept a far greater agency in defining long-term priorities such as combating climate change and communicating the short-term sacrifices necessary to achieve them. Incentives will have to be realigned, with governments subsidizing investments in sustainability—and markets rewarding those firms that achieve revenue with resilience. If we are at “war” against the pandemic or future civilizational threats, we should act like it.

The further we look into the future, the more we can imagine how global society may well be reinvented by the coronavirus pandemic. The 14th-century Black Death caused millions of deaths across Eurasia, splintered the largest territorial empire ever known (the Mongols), forced significant wage growth in Europe, and promoted wider maritime exploration that led to European colonialism. These phenomena trace strongly to the plague even if they played out over centuries. The consequences of today’s pandemic will emerge far more quickly, and with the benefit of foresight, we can try to mitigate them, capitalize on them, and build a more resilient global system in the process.

Parag Khanna is founder and managing partner of FutureMap and author of numerous books including Connectographyand The Future Is Asian. Karan Khemka is an investor and director in education companies globally. He previously founded the Asian operations of the strategic consultancy The Parthenon Group (now EY-Parthenon).